Among Asia's Top 100 Consulting Firm

10,000 + Happy Customers

Lowest Fees

4.5+ Google Rating

Expert Assistance

GST Return Filing

What is GST return filing?

Businesses that are registered under GST have to file the GST returns monthly, quarterly, and annually based on the business. Here it is necessary to provide the details of the sales or purchases of the goods and services along with the tax that is collected and paid. Implementation of a comprehensive Income Tax System like GST in India has ensured that taxpayer services such as registration, returns, and compliance are in range and perfectly aligned.

An individual taxpayer filing the GST returns has to file 4 forms for filing the GST returns such as the returns for the supplies, returns for the purchases made, monthly returns, and the annual returns.

GST return filing in India is mandatory for all the entities that have a valid GST registration irrespective of the business activity or the sales or the profitability during the period of filing the returns. Hence, even a dormant business that has a valid GST registration must file the GST returns.

GST return is a document that contains the details of all the income or the expenses that a taxpayer is required to file with the tax administrative authorities.

Eligibility Criteria

Who should file the GST returns?

GST Return filing in India is to be done by the following:

- A person having a valid GSTIN has to compulsorily file the GST returns.

- Also, a person whose annual turnover is crossing Rs. 20 lakh has to obtain a GST registration and file the GST returns mandatorily.

- In the cases of Special states, the limit for the annual turnover is Rs.10 lakh.

Types of GST Returns

What are the different types of GST Returns in India?

| GSTR 1 | Details of the outward supplies of the taxable goods and or services | Monthly |

| Quarterly (If opted under the QRMP scheme) |

| GSTR 3B | Simple returns in which a summary of the outward supplies along with the input tax credit that is declared and the payment of the tax is affected by the taxpayer. | Monthly |

| Quarterly |

| CMP 08 | Statement cum challan to make a tax payment by a taxpayer registered under the composition scheme under Section 10 of the CGST Act. | Quarterly |

| GSTR 4 | Returns to be filed by the taxpayer that is registered under the composition scheme under Section 10 of the CGST Act | Annually |

| GSTR 5 | Returns to be filed by a Non-resident taxable person | Monthly |

| GSTR 6 | To be filed by the input service distributor to distribute the eligible input tax credit | Monthly |

| GSTR 7 | Is filed by the government authorities | Monthly |

| GSTR 8 | Details of supplies that are affected through the e-commerce operators and the amount of tax that is collected at the source by them. | Monthly |

| GSTR 9 | Annual return for a normal taxpayer | Annually |

| GSTR 9C | Certified reconciliation statement | Annually |

| GSTR 10 | Is filed by the taxpayer whose GST registration is canceled | Once the GST registration is canceled or surrendered |

| GSTR 11 | Details of the inward supplies are furnished by a person who has UIN and also claims a refund. | Monthly |

Due dates for filing the GST returns

What are the due dates for filing GST returns?

GSTR 1: The 11th of Subsequent of that month

GSTR 3B: The 20th of that subsequent month

CMP 08: 18th of the month succeeding the quarter of the specific fiscal year.

GSTR 4: 18th of the month succeeding the quarter.

GSTR 5: 20th of the subsequent month

GSTR 6: 13th of the subsequent month

GSTR 7: 10th of the subsequent month

GSTR 8: 10th of the subsequent month

GSTR 9: 31st December of the Fiscal year.

GSTR 10: Within 3 months of the date of cancellation or the date of cancellation order whichever is earlier.

GSTR 11: 28th of the month that is following the month for which the statement was filed.

GST Return Filing Process

How to file the GST returns?

IndiaFilings is a leading business service platform in India that offers end-to-end GST services. We have helped thousands of business owners to get GST registration, as well as file GST, returns.

- When GST return filing is outsourced to IndiaFilings a dedicated GST advisor is assigned to the business.

- This dedicated advisor would reach out to you every month and collect the necessary information, prepare the GST returns and help in filing the GST returns.

Why IndiaFilings for Filing GST returns?

Filing GST returns takes around 1 to 3 working days subject to the availability of the government portal and the submission of documents by the client.

Return Filing under the Composition Scheme

All persons registered under the Composition Scheme are required to pay taxes using CMP-08 every quarter and GSTR 4 to be filled annually through the GST Common Portal or a GST Facilitation Centre. GST return for those enrolled under Composition Scheme is due on the 18th of the month, succeeding a quarter. Hence, the GST return for the composition scheme would be due on April 18th, July 18th, October 18th, and January 18th. The GST return filed by a Composition Scheme supplier must include details of:

- Invoice wise inter-State and intra-State inward supplies received from registered and unregistered persons

- Consolidated details of outward supplies made

IIf a registered person opted to pay tax under composition scheme from the beginning of a financial year, then the taxpayer must file monthly GST returns on the 10th, 15th, and 20th of each month and monthly returns till the due date of furnishing the return for September of the succeeding financial year or furnishing of annual return of the preceding financial year, whichever is earlier. Hence, even if a taxable person under GST opted for a composition scheme from April onwards, the taxpayer must continue filing monthly GST returns until September.

Benefits of choosing IndiaFilings for the GST returns

Dedicated GST Advisor

A relationship manager with experience in the sector that you operate in will guide you through the process of GST registration and filings. They will help with specific tasks such as uploading invoices and also ensure that your filing is taken care of on time.

Reminder to file GST returns

Our platform ensures that you get timely reminders well in advance of the deadline beyond which penalty will be applicable. In addition to this, your GST advisor will also remind you periodically so that no deadlines are missed.

Monthly GST Status reports

Monthly reports detailing the status of GST return filing including GSTR- 3B and the way forward will be shared with the clients by the GST advisors.

GST returns by LEDGERS

GST returns are prepared by LEDGERS- the GST software so that it is error-free and filed on time without hassles.

GSTR- 1 and GSTR- 3B filing

GSTR-1 is a quarterly return that should be filed by every business. Turnover determines the due dates for GSTR- 1. Business with sales up to Rs. 1.5 Crore can file their quarterly returns.

Input Tax Credit Reconciliation

Businesses will be enabled to benefit from the input tax reconciliation mechanism provided by the government to achieve neutrality in the incidence of tax and ensure that such input tax element does not enter into the cost of production or cost of supply of goods and services.

Standard accounting and cloud records

All of your financial transactions and invoices will be recorded in LEDGERS by accountants so that the filing of all your returns including ITR, TDS, and GST is seamless and cost-effective.

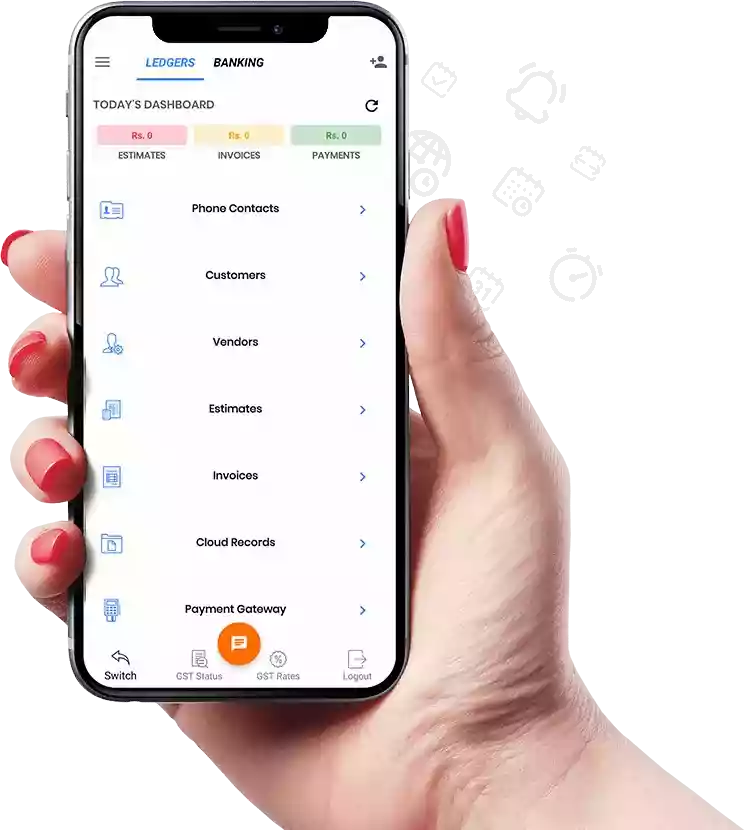

LEDGERS GST Software

In addition to the GST advisor support, LEDGERS GST Software will be provided to the client for GST invoicing, payments, returns filing and accounting.

Some of the features of LEDGERS are:

- Customer management

- Supplier management

- GST Invoicing

- Estimate issuance & tracking

- Accounts receivables tracking

- Purchase register

- Payments tracking

- Payables management

- Automated GST return filing (GSTR-1, GSTR-3B)

- Automatic Input Tax credit reconciliation

- GST eWay bill generation & management

- ICICI bank integration

Penalties

What are the penalties, late fees, and interest rates?

If there are any offenses committed then a penalty has to be paid under GST

Late filing

Late filing of the GST returns can attract a penalty called a late fee. And according to the Goods and Service Tax can attract a penalty which is Rs. 100 under CGST and Rs.100 under SGST that accounts for Rs.200 a day.

With the late fee, an interest of 18% has to be paid per annum. It is calculated on the tax to be paid.

Non-compliance

In case if the taxpayer is not filing the GST returns then the subsequent returns cannot be filed. Hence, to avoid heavy fines and penalties it is better to file the GST returns on time as it will lead to a cascading effect.

For 21 offenses with no intention of fraud or tax evasion

An offender who is not paying taxes or is making short payments must pay a penalty of 10% of the amount of tax due subject to a minimum of Rs.10,000.

For 21 offenses with the intention of fraud or tax evasion

An offender is subject to a penalty amount of tax evasion or short deducted.

Even in case if there is no business the taxpayer is required to file the Nil GST returns.

Staggered Return of GSTR-3B

| Turnover | Deadline for Dec 2020 | Applicable to |

|---|---|---|

| More than 5 crores | 20th of Every month | All the states and UTs |

| Less than 5 crores | 22nd of Every month for Group A States | Chhattisgarh, Madhya Pradesh, Gujarat, Daman and Diu, Dadra and Nagar Haveli, Maharashtra, Karnataka, Goa, Lakshadweep, Kerala, Tamil Nadu, Puducherry, Andaman and Nicobar Islands, Telangana and Andhra Pradesh |

| Less than 5 crores | 24th of Every month for Group B States | Jammu and Kashmir, Laddakh, Himachal Pradesh, Punjab, Chandigarh, Uttarakhand, Haryana, Delhi, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand and Odisha |