Among Asia's Top 100 Consulting Firm

10,000 + Happy Customers

Lowest Fees

4.5+ Google Rating

Expert Assistance

Section 8 Company Registration

Section 8 Company Registration Online in India is the method of enrollment of an NGO under the ‘Companies Act 2013’. Any company that registered under section 8 can promote ‘Charity’, ‘Art’, ‘Science’, ‘Education’, ‘Technology’, ‘Commerce’, ‘Sports’, ‘Social Research’, ‘Social Welfare’, ‘Religion’, and ‘Protection of surroundings or Environment’ and so on. When you think about offering liberating possibilities for incorporating your Business, nothing compares naturalistic than Kanakkupillai Advisors! Surpass on tax Benefits right now!

Overview of Section 8 Company Registration

Section 8 Companies are similar to Trusts and Associations. Section 8 Company can be registered for charitable purposes. Know about the documents required for section 8 company Registration, Section 8 Company Incorporation. The main purpose of registration of a company as a Section 8 company is to promote non-profit objectives. Register a Section 8 Company with Kanakkupillai, Fast Online Process, No Hidden Fees.

An NGO can be recorded as a Section 8 company following the Companies Act 2013 or as a trust supporting the Trust Act 1882 or as a general public under the ‘Societies Act 1860’. Section 8 Company Registration is the technique for consolidation of an NGO under the ‘Companies Act 2013’. Register a Section 8 Company for advancing ‘Education’, ‘Religion’, ‘Social welfare’, ‘Technology’, ‘Charity’, ‘Art’, ‘Social Research’, ‘Commerce’, ‘Science’, ‘Sports’ and ‘Security of Environment’ and so forth.

Most recent Incorporation Of Section 8 Companies As Per Companies Act 2013- Sixth Amendment 2019. MCA consult organization sixth Amendment Rules, 2019 dated seventh June, 2019 has reconsidered the incorporation norms for joining Section 8 Companies. The rule has happened from August 15, 2019.

Subsequently, the new rule has made the permit and section 8 company registration simple. Presently candidates can apply for the registration of Section 8 Companies by means of filling a solitary application in Form SPICe. MCA website has given the following instructions that will dispel any confusion quality of uncertainty:

Pending Form INC-12 SRNs for new Companies forthcoming with respect to particular RoCs will be considered as ‘Rejected’ on 15th August 2019. Those applicants can legitimately document SPICe to get License Number and for forming Section 8 Companies. Shareholders who effectively own a permit number and are standing by to document SPICe form so that they can consolidate Section 8 Companies should take note of that the forms will be prepared once the specific delay time is considered and work process changes to produce results. Those shareholders who are finished with the filling of SPICe forms however are forthcoming with respect to CRC may need to hang tight for the preparation of these forms once the work process change comes into action.

Advantages of Section 8 Company Registration

Involving a Non-benefit Organization does not show that the Company cannot make sure about a benefit or commission. Various Tax exemptions are additionally there for such organizations. Indeed, even the donors giving under section 8 of companies act 2013 have the alternative to guarantee the Tax Exemption against these donations. It just suggests that the Company can acquire income, but the advertisers are not to profit from those benefits. A few advantages of them are as given underneath:

Separate Legal Identity

Section 8 Company certification has a different lawful element and it takes an unmistakable legitimate character from its legs and arms.

No Least Capital

There is no base capital essential for a Section 8 Company Registration inside India. No Stamp Duty

No Stamp Duty

No stamp obligation is required on the fuse of Section 8 Company in India as it is confronting the arrangement of the portion of stamp obligation on the MoA and AoA of the private restricted Business.

Credibility

Section 8 Company license has more dependability than some other type of magnanimous/beneficent association.

Exclusion To The Donators

Under Section 80G, the avoidance is granted to the contributors if section 8 company is registered under section 80G.

Tax reductions

There are many assessments paid under the Section 8 Company Registration in India.

Required Documents for Sec 8 Company Registration

- Voter ID

- PAN Card of all the Members

- Phone Bill/Electricity Bill

- Most recent Bank Statement of all the Members and the Company

- Aadhaar Card of all the Members

- Passport size photograph of all the members

- Copy of the Rental agreement

- Passport

- Driving license

Eligibility Criteria to apply for Section 8 Company Registration

- An individual or HUF or restricted Company is prepared to begin a Section- 8 company registration inside India.

- At least two people who will act as a shareholder or director of the Company ought to satisfy all the states of the ngo Section 8 Company registration.

- Any of the individuals from the Company can't attract any pay any type of money or kind.

- At any rate, one of the directors will be a resident of India.

- No benefit ought to be shared among the individuals and director of the Association directly or indirectly.

- The expectation ought to be the headway of sports, social government assistance, the advancement of science and workmanship, training and budgetary help to bring down lower-income societies.

- The Company should have an unmistakable vision and framework plan for the following three years.

- The overflow made must be utilized for arriving at the principal purpose of formation of section 8 company exclusively.

- Yearly recording of records, reports and the profits of the Association with the ROC is needed to meet the compliance required.

- Property Management: The responsibility of the property lies for the sake of the Company, and it must be sold according to the principles referenced under the Companies Act. (Ex: With the assent of the Board of Directors as a goal).

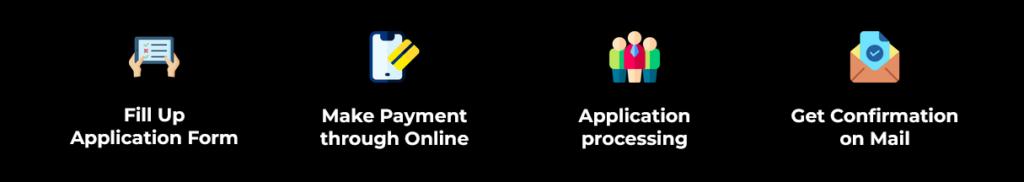

Section 8 Company Registration Procedure

In regard to improving the way toward consolidating Section 8 section companies on 7th June 2019 requirement of the prerequisite of earlier recording INC-12 has been administered vide the Companies (Incorporation) Sixth Amendment Rules,2019.

Name Application/Reservation in the SPICe+ Form

Apply for name accessibility through SPICe+ structure office. It is important for incorporate Section 8 Companies to have words like Electoral Trust, Federation, Council, Association, Chambers, Foundation, Forum, Confederation, in its name.

Candidates can give two names one after another and can perform only one resubmission in the SPICe+ form.

The readiness of MOA and AOA

Update of affiliation functions as a sanction of the organization and frees the domain from the organization’s activities. While an article about the relationship of the organization tells about the inner administration of the organization.

Use Form INC-13 to document MOA of a Section 8 Company, additionally, there is no endorsed design referenced for AOA of a Section 8 Company.

Each subscriber needs to sign the notice and article of the association who will likewise need to give his name, address, depiction, and occupation, assuming any, within the sight of a base one observer who will confirm the mark and will happen to sign and include his name, address, portrayal, and occupation.

Outline- Absolute Number of Board Meetings and its Plenum

According to the exemption warning read with segment 173(1) and 174(1), Section 8 company registration must have at any rate one gathering inside six schedule months, and the plenum for its executive gatherings is eight chiefs or 1/fourth of its complete fixation, whichever is less, successively. Nonetheless, participation ought to have at least two individuals.

Issuance of 80G Certificate

80G Certificate is given to a non-benefit association or non-administrative associations (NGO), an ‘altruistic’ trust or a Section 8 Company by the Income Tax Department’. The prime advantage is that the donor benefits by giving to such an NGO that he gets charge exclusion on half of his foundation as the giver is allowed to reduce their gifts from their Gross Total Income. The point behind the 80G certificate is to elevate more givers to charitable funds to such associations.

Issuance of 12A Registration

Altogether, utilizing 12A NGO registration, Trusts and NGOs and other section 8 non profit company get an exemption from giving personal duty. NGOs are primarily organizations that are made for beneficent and non-benefit activities. Notwithstanding, they do have incomes and would be needed to pay the expense according to standard rates if not registered under section 12A of the Income Tax Act.

Frequently Asked Questions

Yes. According to ‘rule 8(7) of the Companies (Incorporation) Rules, 2014’, for the Companies under ‘Area 8 of the Act’, the name ought to incorporate the establishment of the word like and so forth. If a Section 8 Company, which is associated with CSR ventures likewise needed to compulsorily

Yes, one individual organization may change itself into a private/public organization, and afterwards, recovery of such private/public association into Section 8 is reasonable.

No. Section 8 Companies are out from the duty of arrangement of independent directors.

Relies upon cases, No relaxation is given by any state on the issue of share certificates.